The client faces difficulties in managing policies, claims, and customer data manually, leading to delays and errors. Customers find it challenging to access, compare, or purchase insurance plans online. Limited digital tools reduce transparency and slow communication between the insurer and clients. Additionally, the absence of real-time tracking and analytics makes it hard to monitor performance and improve operational efficiency.

Liberty Mutual Insurance Portal

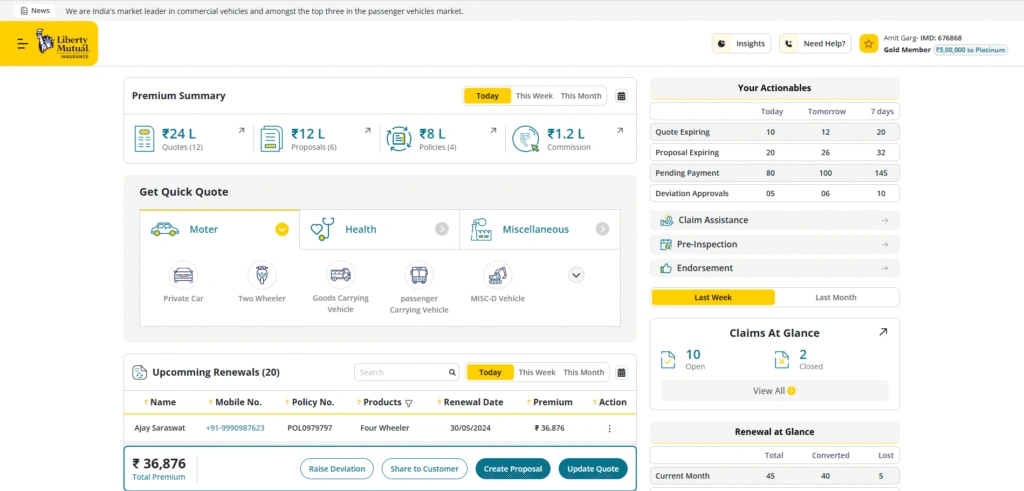

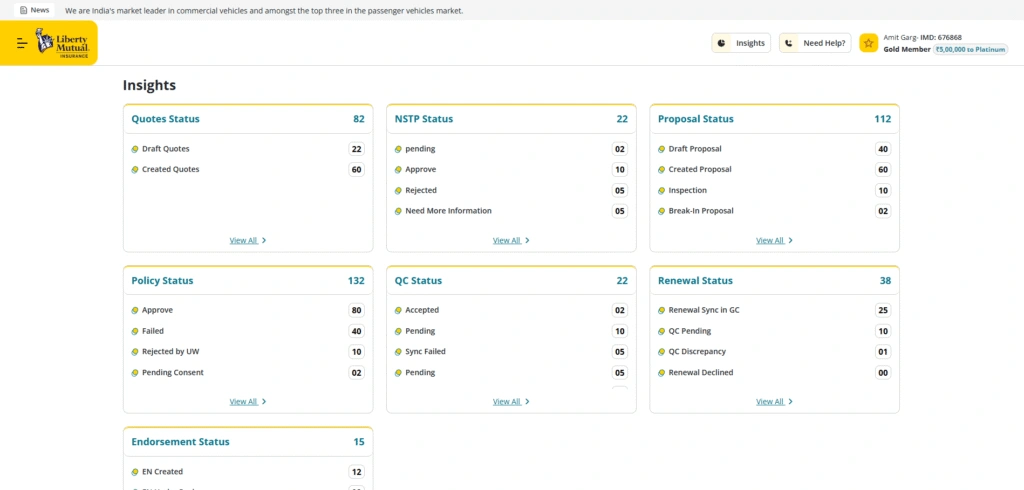

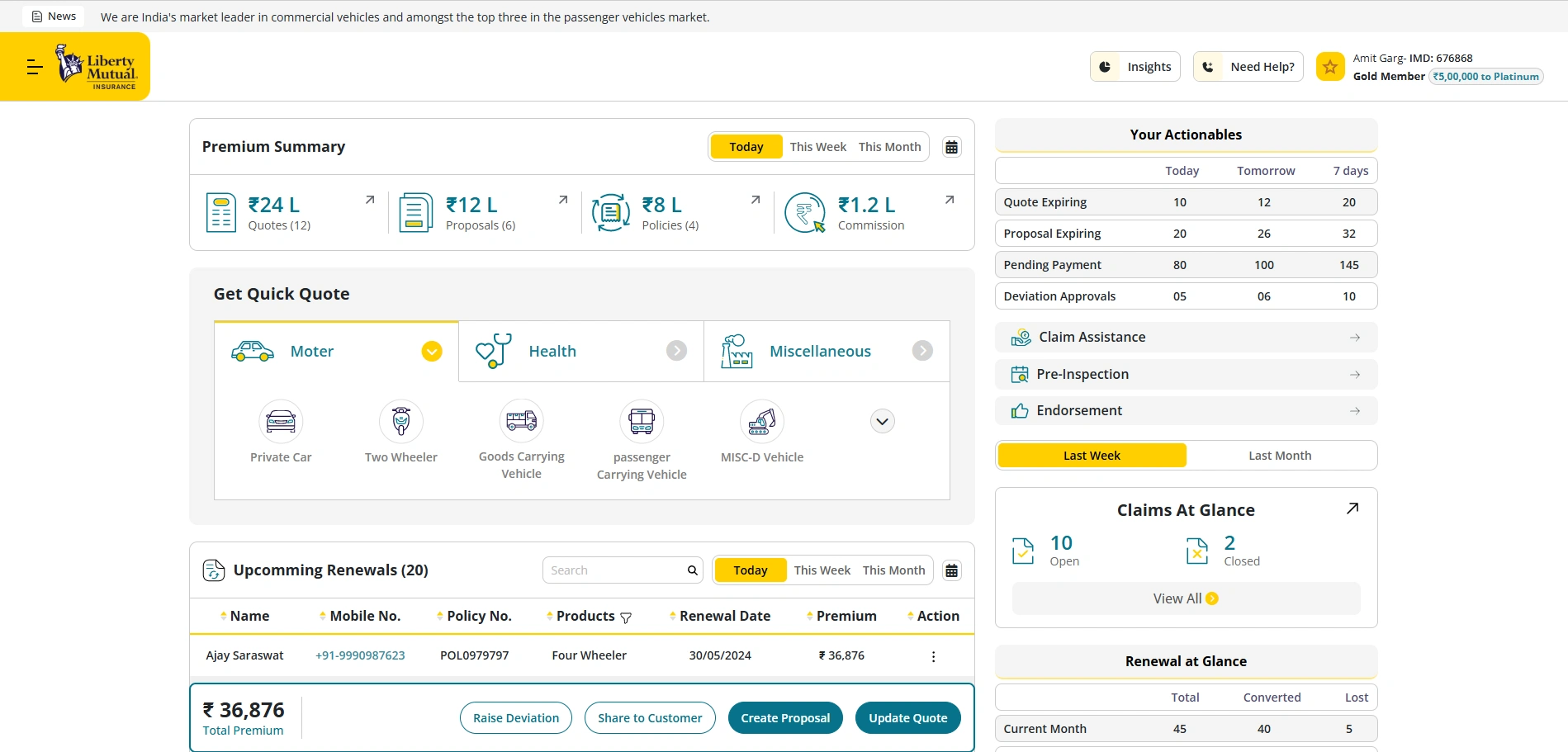

The Liberty Mutual Insurance Platform is a complete tool made to help agents, brokers, and business clients work more easily and efficiently. It helps manage important insurance tasks like handling policies, renewals, claims, and finances. The platform has a simple and easy-to-use dashboard that shows important numbers, policy details, premium summaries, and useful insights. This helps users make better decisions and offer improved customer service.

The Liberty Mutual Insurance Platform is an all-in-one insurance operations hub developed to enhance the efficiency and productivity of agents, brokers, and corporate clients. The platform facilitates seamless management of critical insurance processes, including policy administration, renewals, claims processing, and financial oversight. With an intuitive and user-friendly dashboard, users gain immediate access to key performance indicators, policy data, premium overviews, and actionable analytics, ensuring informed decision-making and improved customer service.

Client Needs

Liberty Insurance requires robust IT solutions to modernize operations by streamlining policy management, automating claims processing, and enhancing real-time customer support. Cloud integration and data analytics will empower faster decision-making, personalized product offerings, and optimized pricing. Additionally, user-friendly digital platforms will improve accessibility, enabling customers to manage policies, file claims, and receive support anytime, from any device.

Problem

The client struggles with inefficient manual processes for policy management, renewals, and claim settlements, causing delays and errors. Customers face difficulty in exploring, comparing, and purchasing insurance plans online. Communication gaps and lack of real-time updates reduce transparency and trust. The absence of centralized data and analytics makes it hard to track performance, optimize operations, and make informed business decisions, ultimately affecting customer satisfaction and operational efficiency.

Solution

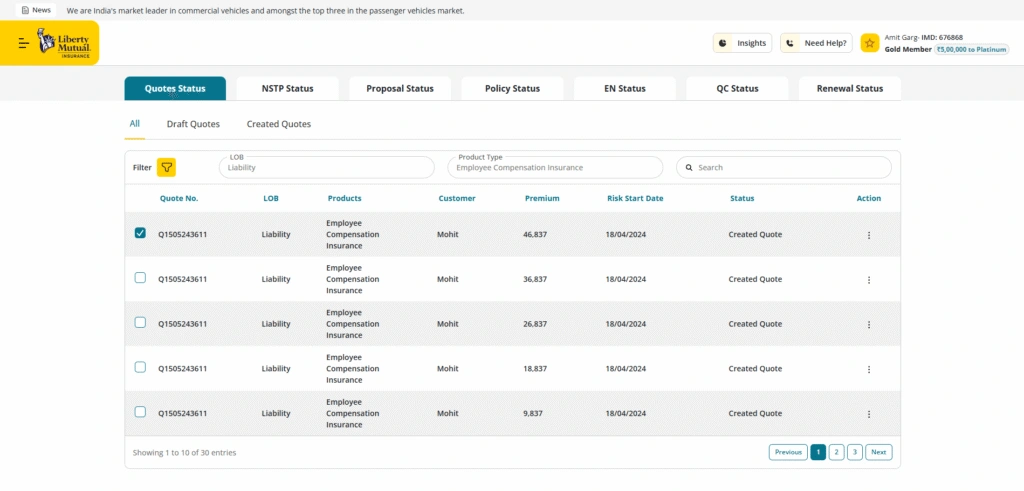

Develop a comprehensive digital portal for Liberty Mutual to streamline insurance management. The system will allow customers to browse, compare, and purchase insurance plans online securely. Automated policy issuance, renewals, and claim processing will reduce errors and delays. Real-time tracking of policies and claims will improve transparency and customer trust. Integrated dashboards and analytics will help monitor performance, optimize operations, and support informed business decisions.

Create a robust and secure digital portal for Liberty Mutual to manage policies, claims, and customer interactions efficiently. The platform will allow users to explore, compare, and purchase insurance plans online with ease. Automated features for policy issuance, renewals, and claim processing will reduce manual errors and delays. Real-time updates and tracking will enhance transparency and customer trust. Collaboration tools and notifications will improve communication between customers and the insurer.