ForMoney Insurance is a digital platform designed to simplify insurance services for customers and providers. It enables users to explore, compare, and purchase various insurance plans online with ease. The system supports secure data management, policy issuance, renewals, and claim processing. Customers can track their policies and claims in real time, enhancing transparency and satisfaction. For insurers, it streamlines operations, reduces manual work, and improves efficiency. Overall, it offers a fast, reliable, and user-friendly insurance experience.

Formoney Insurance

Technologies

- HTML

- CSS

- BOOTSTRAP

- ANGULAR

- NODE-JS

- MONGODB

Demo Credentials

Username: demo@formoney.com

Password: demo@1234

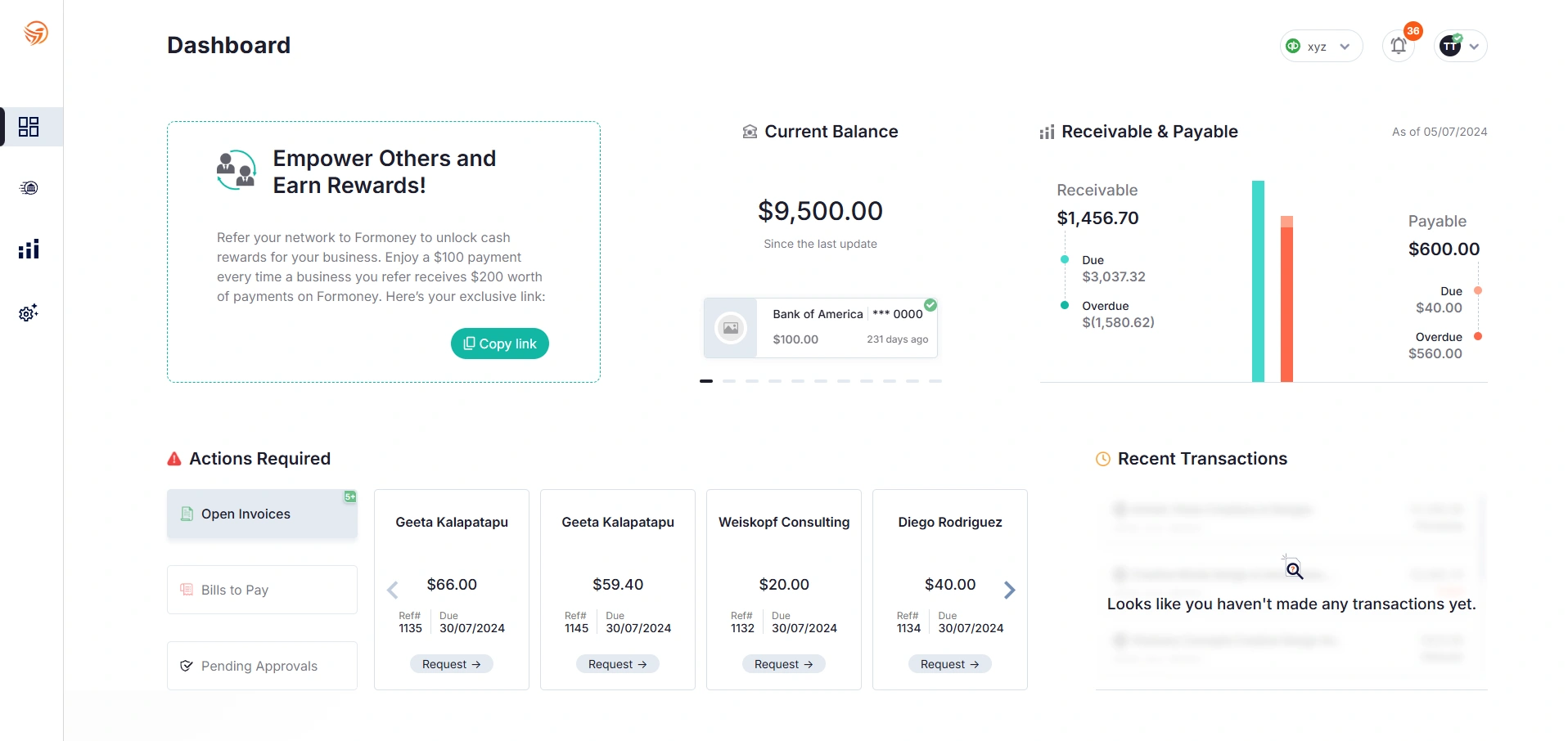

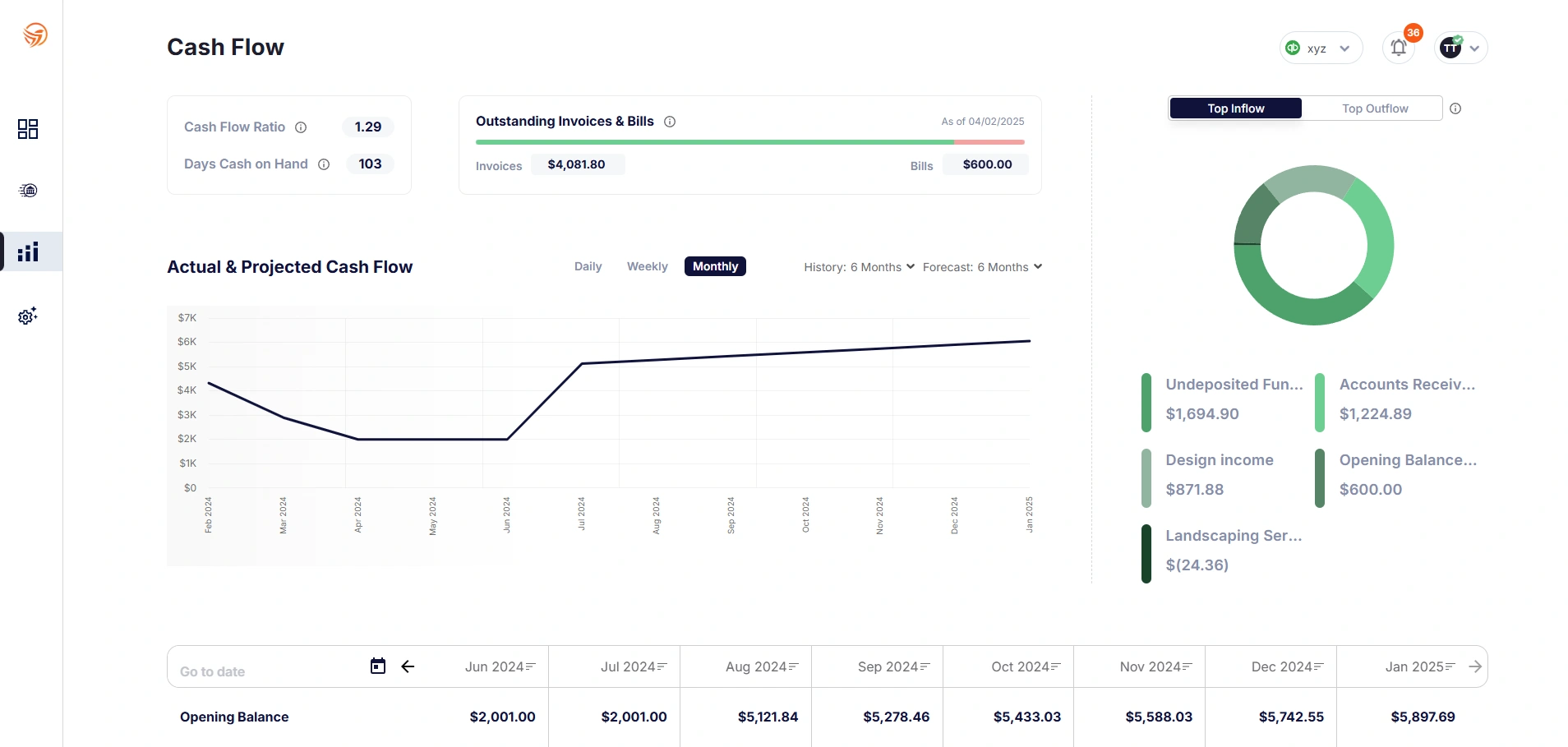

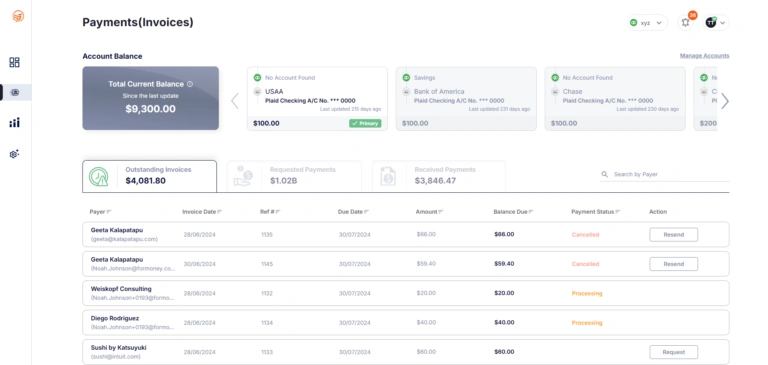

ForMoney Insurance is a comprehensive online platform that makes insurance accessible and convenient for both customers and providers. It allows users to browse, compare, and purchase different insurance plans quickly and securely. The system manages customer data, policy issuance, renewals, and claims efficiently. Real-time tracking of policies and claims ensures transparency and enhances customer trust. For insurers, it automates operations, reduces paperwork, and improves overall productivity. The platform also provides analytics and reports to help make informed business decisions and improve services.

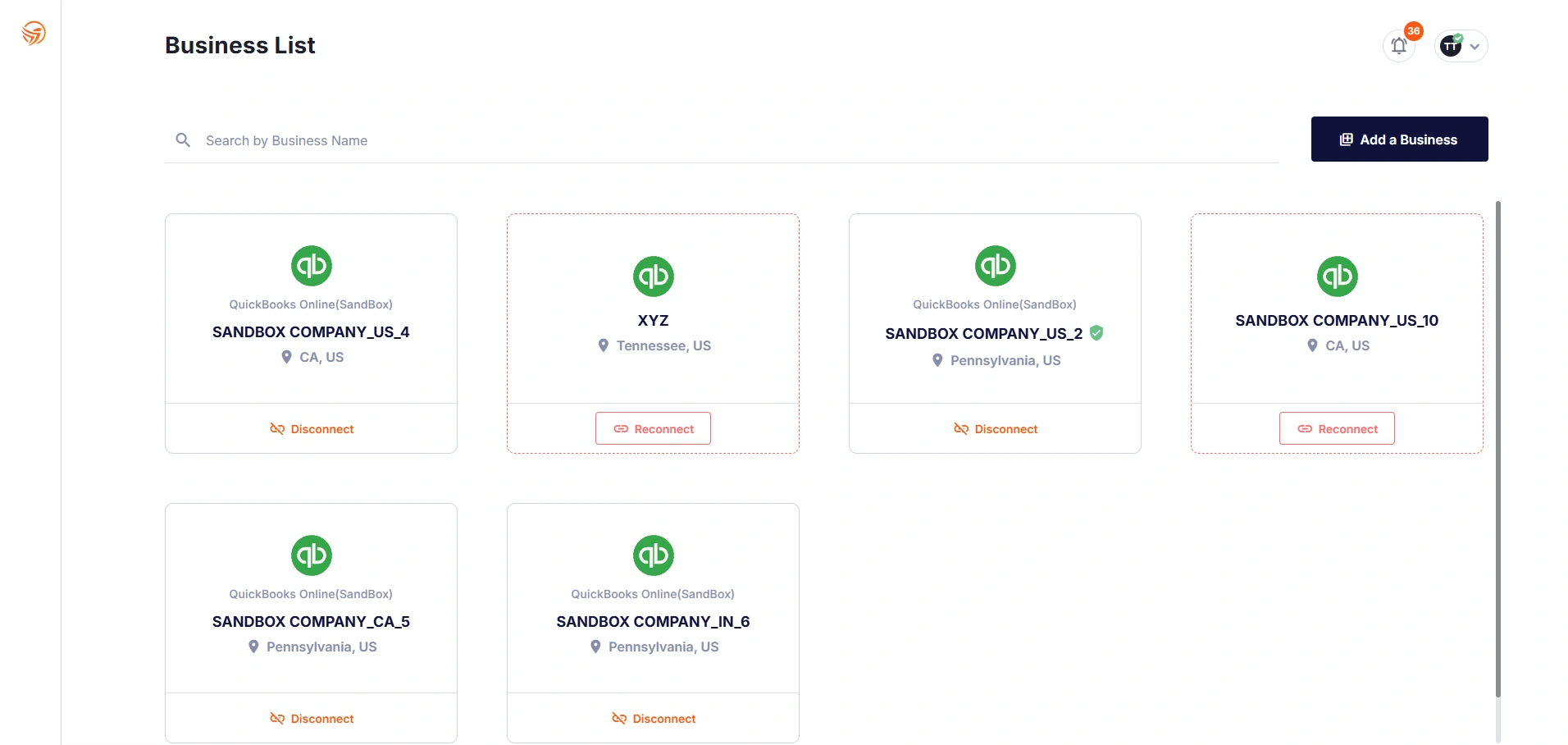

Client Needs

The client needs a secure and efficient digital platform to manage insurance services. The system should allow customers to explore, compare, and purchase insurance plans online. It must support policy issuance, renewals, and claim processing with real-time tracking. Customer data should be stored securely, ensuring privacy and compliance. The client also requires analytics and reporting tools to monitor policies, claims, and overall business performance.

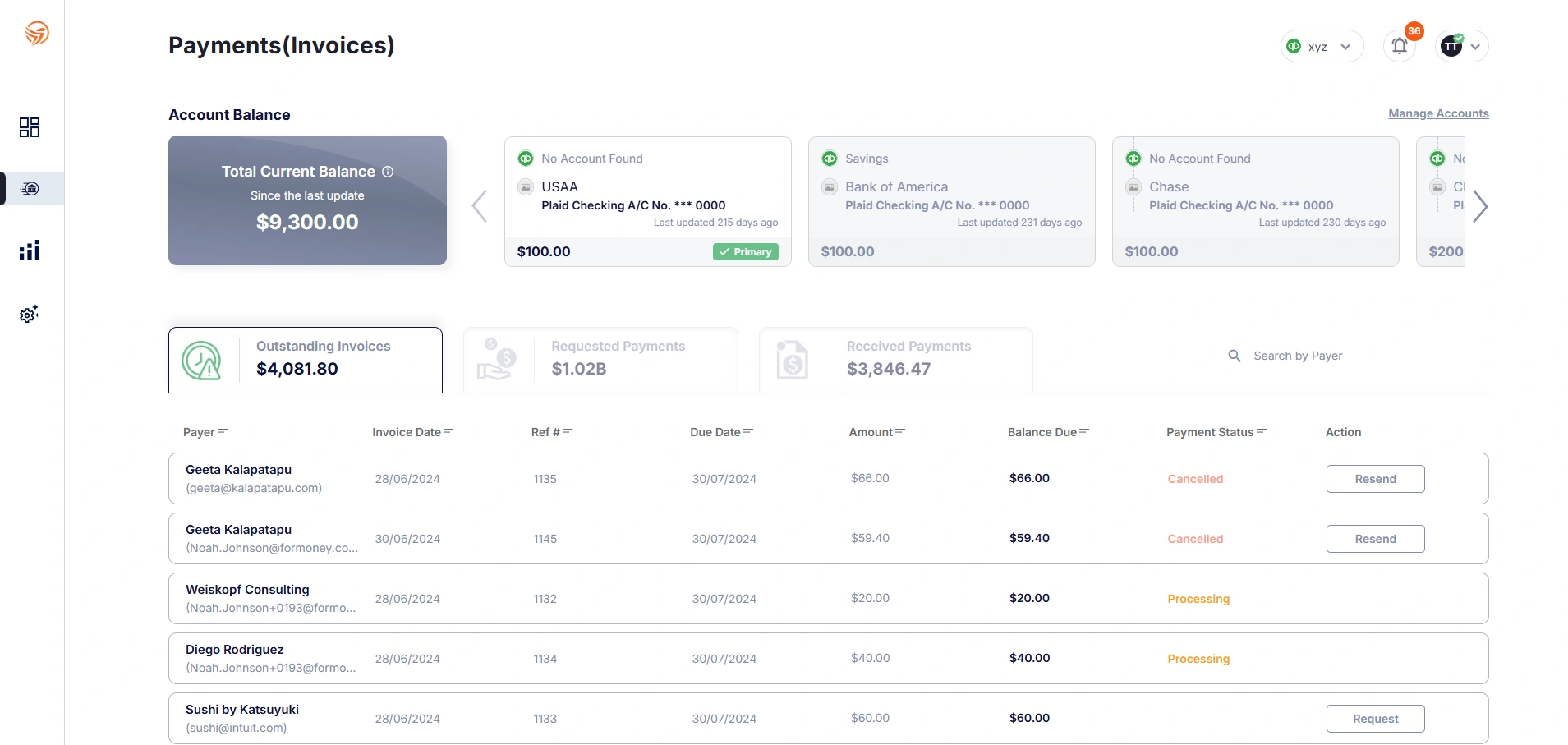

Problem

The client faces challenges in managing insurance policies and claims manually, leading to delays and errors. Customers struggle to compare plans or track their claims efficiently. Limited digital presence reduces accessibility and slows down service delivery. Lack of real-time data and analytics makes it difficult to monitor performance and improve operations.

The client struggles with inefficient manual processes for policy management, renewals, and claim settlements, causing delays and errors. Customers find it difficult to access, compare, or purchase insurance plans online. Limited digital tools reduce transparency and slow down communication between insurers and clients. Additionally, the absence of analytics makes it hard for the client to track performance, optimize operations, and make data-driven decisions.

Solution

Create a comprehensive digital platform for ForMoney Insurance to manage policies, claims, and customer interactions efficiently. The system will allow users to explore, compare, and purchase insurance plans online securely and conveniently. Automated policy issuance, renewals, and claim processing will minimize errors and speed up service delivery.

Create a comprehensive ForMoney Insurance digital platform to streamline insurance operations for both customers and providers. The system will allow users to securely browse, compare, and purchase insurance plans online. It will automate policy issuance, renewals, and claim processing, reducing manual errors and delays. Real-time tracking of policies and claims will increase transparency and customer trust.