About Us

When it comes to manage IT company in india for your business. You need an expert. Let us show you what responsive, reliable and accountable IT Support looks like in the world.

Contact Info

- 311, ABC, Opposite Torrent Power Sub Station, SP Ring Rd, Nikol, Ahmedabad, Gujarat 382350

- (+91) 8980 706 941

- contact@syfrox.com

- Mon - Fri: 09.30 to 07.00

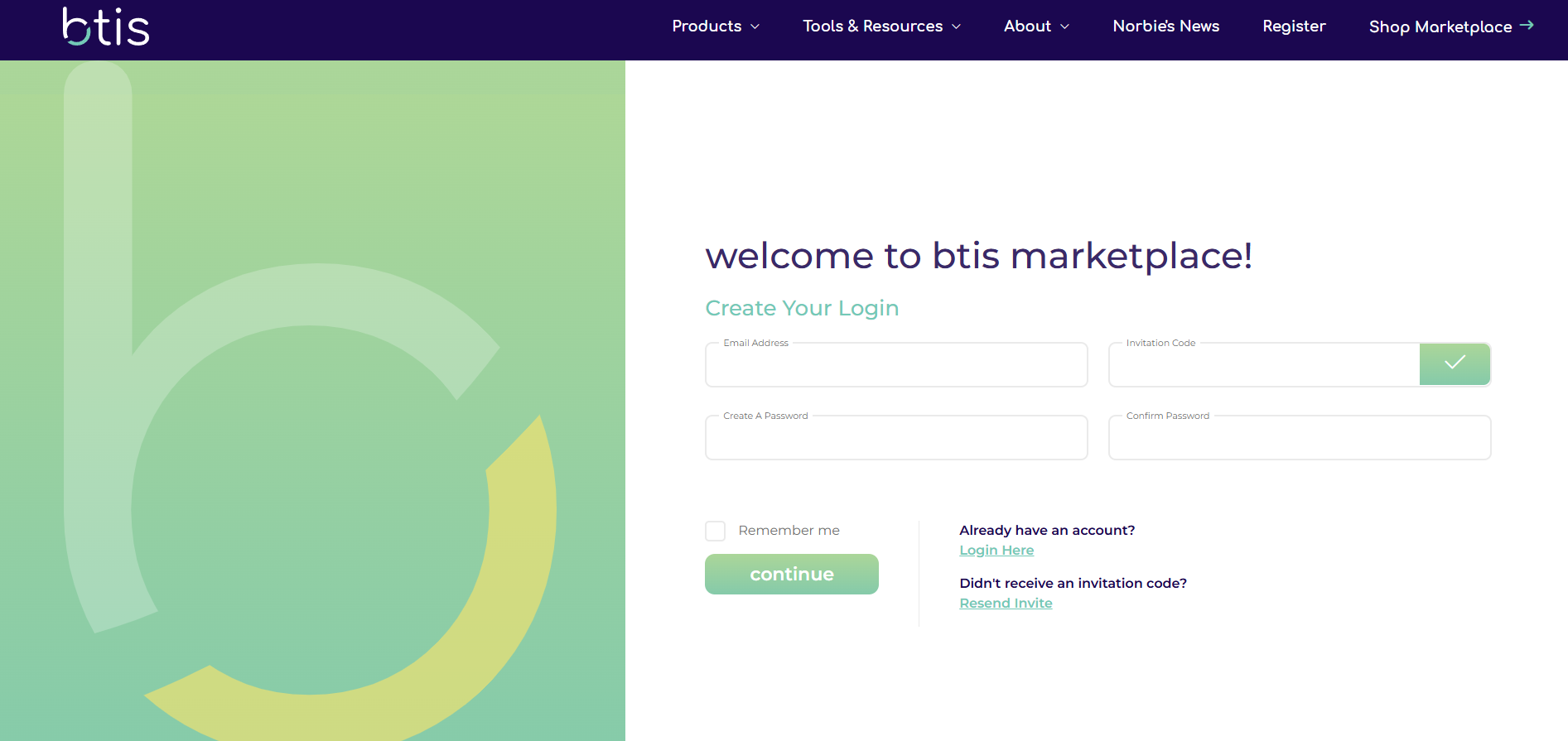

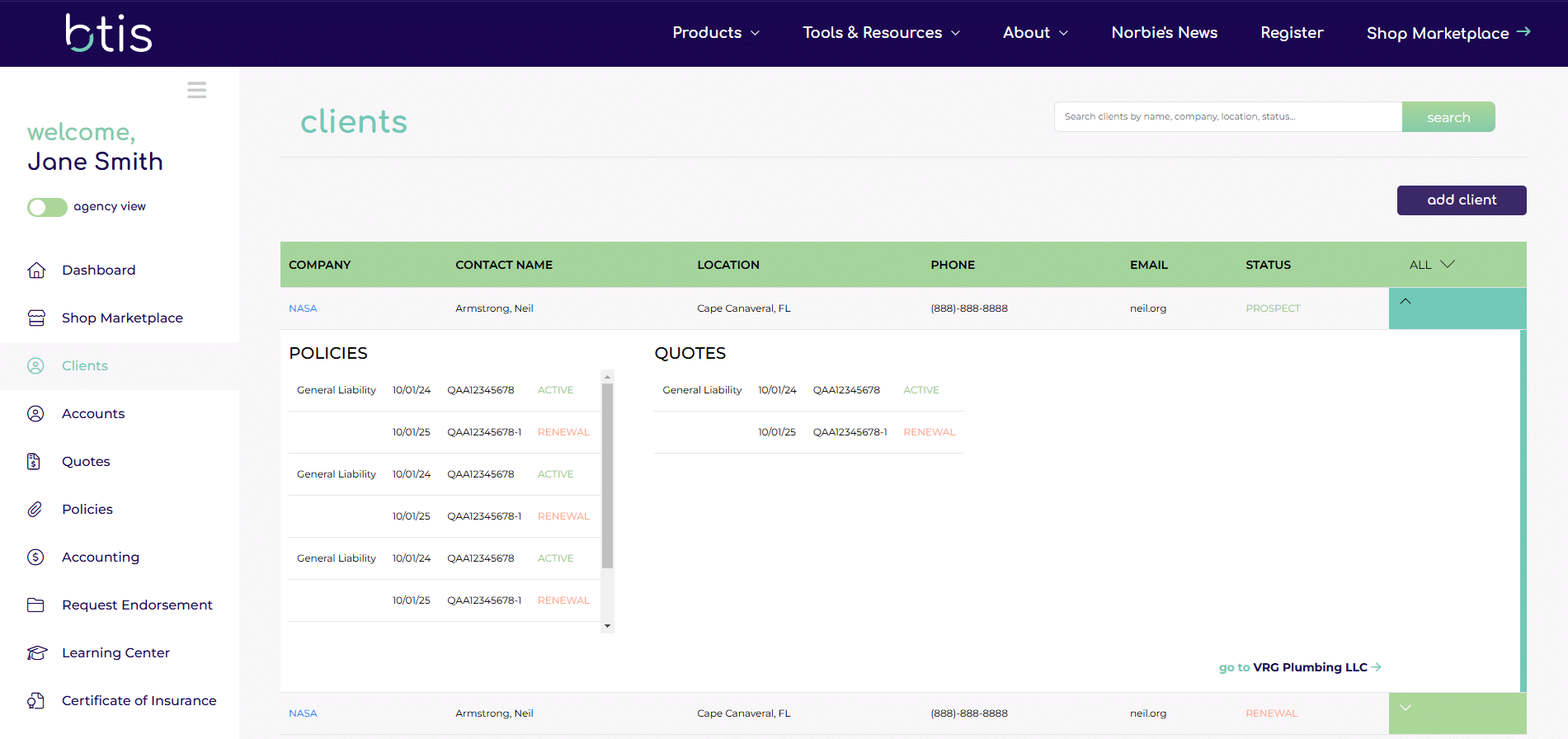

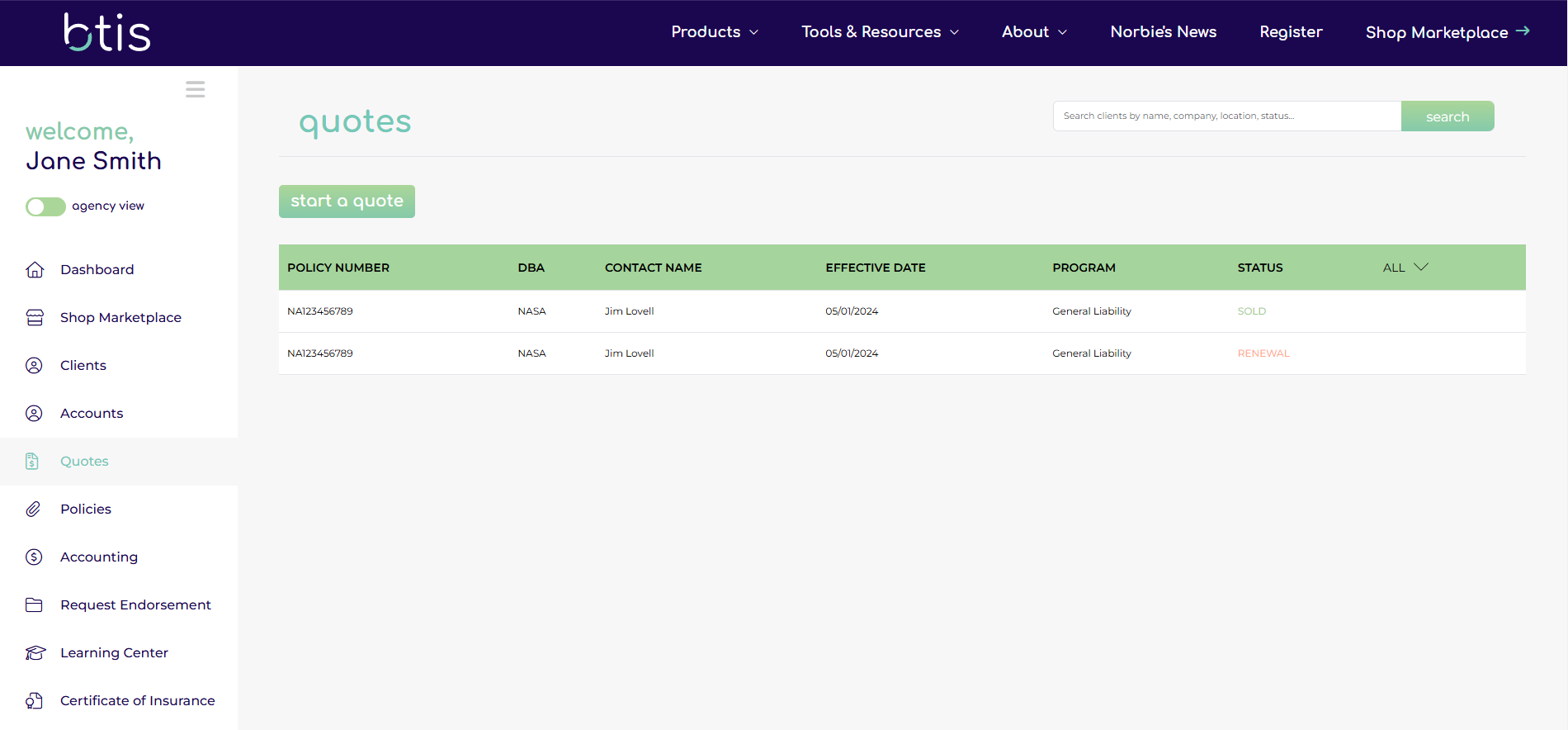

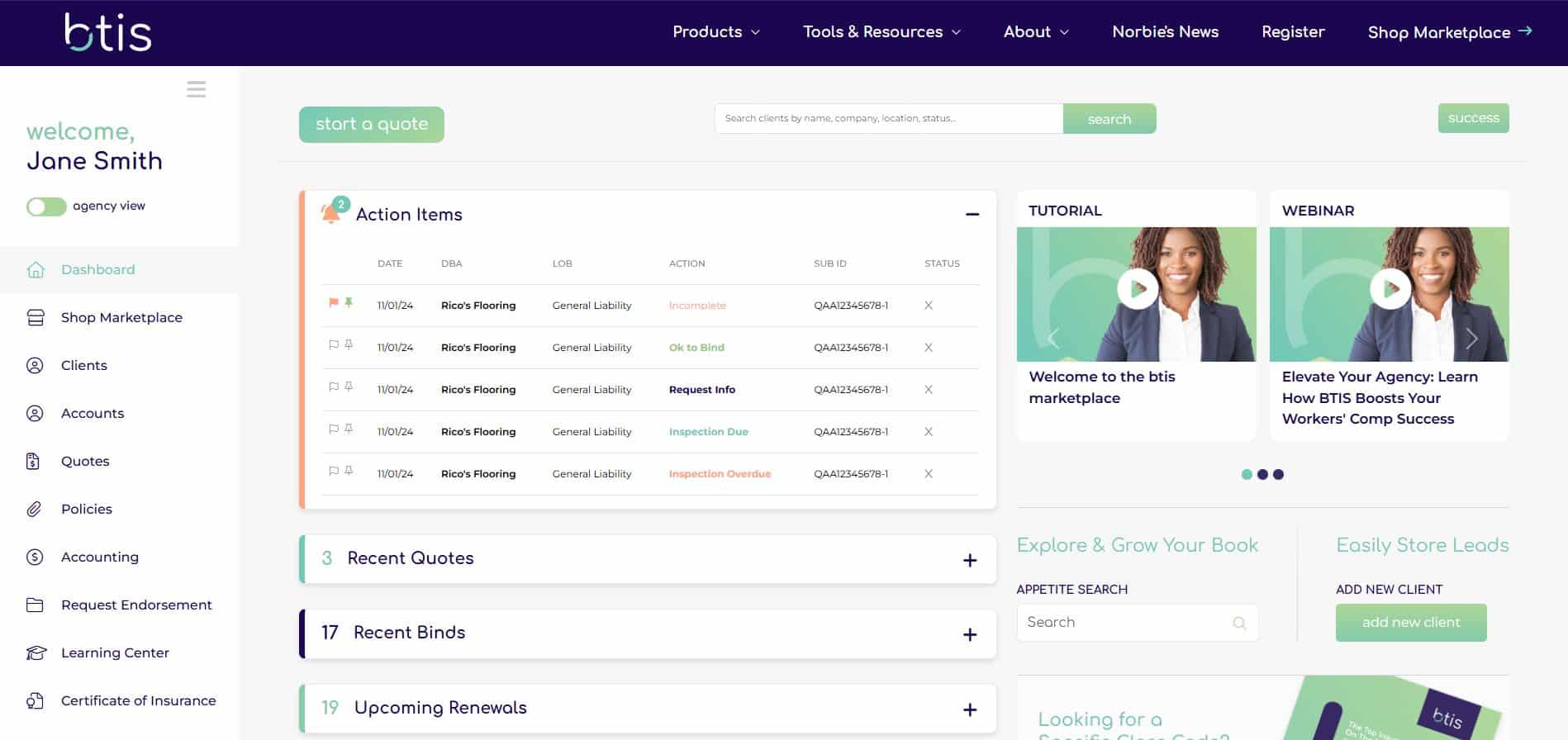

BTIS Insurance

BTIS is recognized for offering a diverse range of insurance solutions designed to provide comprehensive coverage across multiple sectors. Their offerings typically include protection plans in areas such as health, life, property, and personal assets, all of which are customized to suit individual client needs. BTIS prides itself on delivering flexible and client-centric insurance services, ensuring that each policy is aligned with the specific circumstances and priorities of its customers. It’s important to note that “BTIS” may also refer to specialized programs or unique insurance products developed exclusively by BTIS Insurance Company, which can vary depending on the services offered and the markets they serve.

Client Needs

At BTIS Insurance Company, understanding and meeting client needs is at the core of every service offered. Each insurance plan—whether for health, life, property, or personal protection—is carefully tailored to match the unique circumstances of the individual or business. BTIS takes a personalized approach, ensuring that clients receive the right coverage with flexibility and clarity. By offering a wide range of customizable solutions, BTIS empowers clients to protect what matters most with confidence and peace of mind.

Challenges

The platform displays invoice statuses such as NEW and OVERDUE, but timely updates and real-time notifications are essential to help users avoid missed payments. Without an automated reminder system in place, there’s a higher risk of overdue invoices going unnoticed, potentially resulting in policy lapses or cancellations.

While users can make payments using Credit/Debit Cards or Bank/ACH transfers, it’s vital to ensure that failed transactions are handled effectively. When a payment is declined or a transfer doesn’t go through, the system should provide users with clear, actionable error messages to resolve the issue quickly.

Solution

Enable Real-Time Notifications – Real-time notifications instantly alert users about important events as they happen, keeping them engaged and informed. These notifications can be delivered through in-app alerts, push messages, or emails using technologies like WebSockets or Firebase Cloud Messaging.

Add a Payment Reminder System – A payment reminder system automatically notifies users about upcoming or overdue payments through emails, SMS, or app alerts. It helps reduce late payments and improves cash flow by sending timely, customizable reminders.